Smart Money Moves:

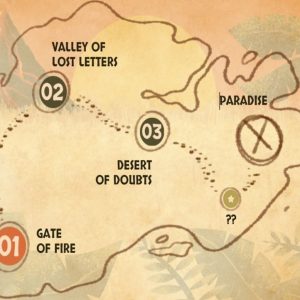

Test your knowledge: Save the Dinosaurs!!!

Have you ever wondered how some people seem to make their money grow like magic? Well, it’s not magic at all—it’s the power of saving and investing! Let’s explore how you can start building your financial future today.

Imagine you want the latest gaming console that costs $500. If you spend all your pocket money as soon as you get it, that console might feel impossible to get. But with smart saving habits, it becomes totally achievable.

Think of saving like building your own money fortress. Here’s how to start:

- 50% for needs (like school materials)

- 30% for wants (like chocolate, toys, and movies with friends)

- 20% for savings (your future self will thank you!)

- Use a Money Jar for Short-term goals

- Create a digital savings tracker on your phone

- Ask your parents about opening a savings account

From Saving to Investing: Taking the Next Step

Investing is similar to planting a money tree. You start with a small seed (your savings), and over time, it can grow into something much bigger!

Firstly, consider a savings account as your personal financial vault at the bank. It’s super safe, just like keeping your allowance in a piggy bank, but even better because the bank gives you a little extra money (called interest) just for keeping your savings with them! It’s the perfect way to start your money journey.

Now, imagine having a special account that helps your money grow while you’re learning and playing – that’s what an educational investment account is! It’s like a garden where your parents can help you plant money seeds that will grow bigger and bigger until you’re ready for college or other cool learning adventures. This special garden often grows more flowers (or money!) than a regular savings account.

And here’s something really exciting – did you know you can actually own tiny pieces of your favorite companies? Through the stock market, you can become a mini-business owner! For example, if you love video games or toys, you could own a small piece of the companies that make them. Just remember, the value of these pieces can bounce up and down like a yo-yo, which is why it’s smart to own pieces of different companies—just like not putting all your eggs in one basket!

Smart Tips for young Savers

Your Action Plan

Ready to start your saving and investing journey? Here’s what to do:

- Talk to your parents about opening a savings account

- Create a simple budget using the 50-30-20 rule

- Set a specific saving goal for something you want

- Learn more about how investing works

Remember: Every financial expert started as a beginner. The key is to start early and stay consistent. Your future self will appreciate the wise financial decisions you make today!

Fun

I saved my money in a safe place like the piggybank or the Bank

I consider carefully what I would like to buy with my savings.

I discussed with my friends about what could be the finest investment to make.

Last week, Kunle bought a hen to keep as a pet. This animal may play with Kunle and lay eggs.

The eggs can be hatched into other hens. It will also be a source of meat during Kunle’s birthday, WOW!! what an investment

Wisdom is profitable, You can start saving for the future now no matter how small it maybe.